2022 Irs Tax Calendar

2022 Irs Tax Calendar

This page is being updated for Tax Year 2022. IRS tax return filers IRS Form 1040 and applicable Schedules and includes only the tax return items required by the Department to be verified for 20212022. But President Joe Biden stated that the higher payments may last. IRS Income Tax Forms Schedules and Publications for Tax Year 2022 - January 1 - December 31 2022.

Source: https://www.forbes.com/sites/kellyphillipserb/2021/01/25/tax-refund-chart-can-help-you-guess-when-youll-receive-your-money-in-2021/

Federal Student Aid Subject. For calendar year 2022 the annual contribution limitation for an individual with self-only coverage under a HDHP will be 3650. Tax Day for the year 2022 is celebrated observed on Friday. After the audit check you will get your proof of payment 2290 Schedule 1 in minutes.

The final advance payment of the child tax credit is scheduled to go out by Dec.

Source: https://www.forbes.com/sites/kellyphillipserb/2021/01/25/tax-refund-chart-can-help-you-guess-when-youll-receive-your-money-in-2021/

Source: https://www.forbes.com/sites/kellyphillipserb/2021/01/25/tax-refund-chart-can-help-you-guess-when-youll-receive-your-money-in-2021/2022 Irs Tax Calendar. Ssfusd 2021 2022 calendar Duration between two dates calculates number of days. Online Tax Calendar View due dates and actions for each month. 7 rows Tax Day 2022.

IRS Form 1040 Line 14 minus Line 2 of Schedule 2 43a and 91a 50 and 113 Schedule 3 Line 3 57 and 120 Schedule 1 Line 15 plus 19 59 and 122. According to the payment option you need to enter your bank details such as bank account number routing number etc. 2021-2022 FAFSA Verification-Internal Revenue Service IRS Tax Return Transcript Matrix Attached to this Electronic Announcement is the 2021-2022 FAFSA Verification-IRS Tax Return Transcript Matrix that institutions can use for 2021-2022 verification of IRS tax return information included on the Free Application for.

Source: https://www.forbes.com/sites/kellyphillipserb/2020/09/11/your-first-look-at-2021-tax-rates-projected-brackets-standard-deductions--more/

Please check back regularly for any amendments that may occ. 2022 Estimated Tax Due Date. Business mileage deduction calculator. Online Tax Calendar View due dates and actions for each month.

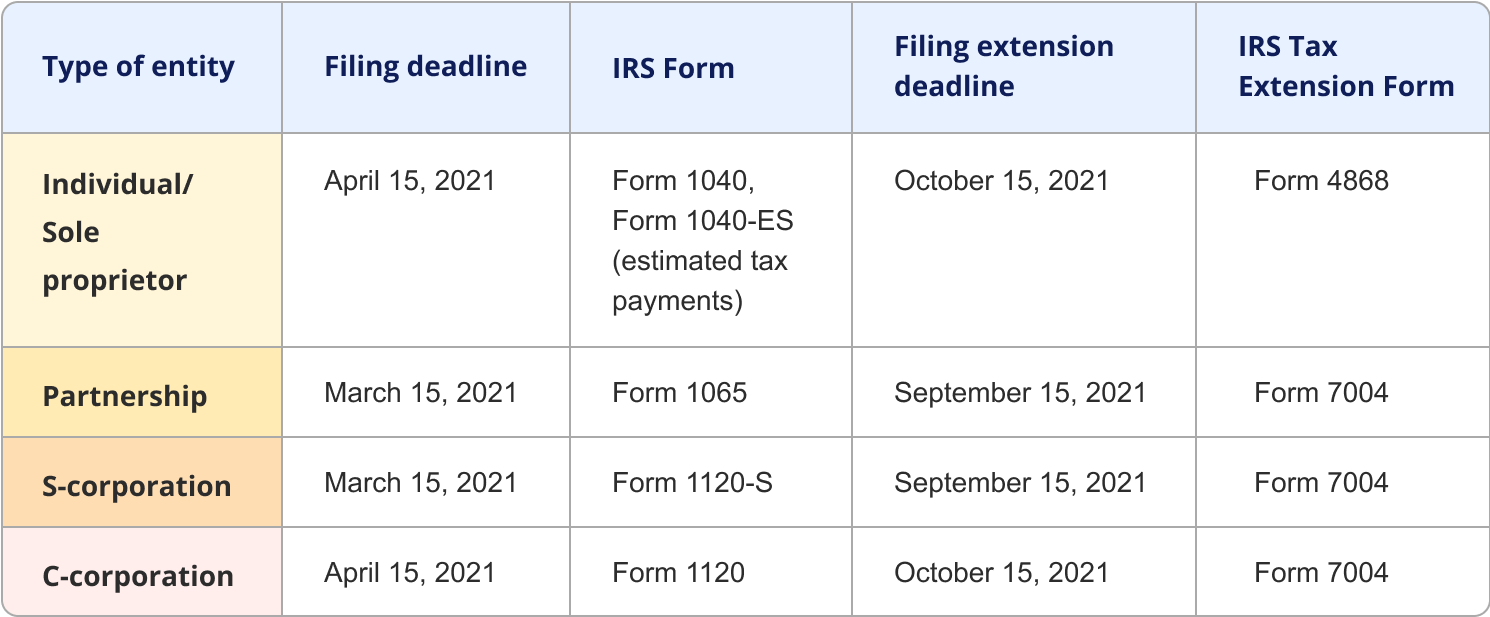

Source: https://www.indinero.com/blog/2021-business-taxes-deadlines

This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in April 2022. Return of tax deduction from contributions paid by the trustees of an approved superannuation fund. Ssfusd 2021 2022 calendar Duration between two dates calculates number of days. Airi january 15 2020 no comments schedule fsc payroll calendar 2020 2020 payroll calendar federal government 2020 pay period calendar federal employees cra payroll calculator 2020 va pay period.

Source: https://blog.pdffiller.com/tax-season-2021-new-income-tax-rates-brackets-and-the-most-important-irs-forms/

For the time being the mileage rate for business is 575 cents. Business Mileage Rate 2022. 31 with the rest coming in 2022 with tax season. File IRS 2290 Tax Form Online for 2021-2022.

Source: https://www.cpapracticeadvisor.com/tax-compliance/news/21214856/irs-makes-it-official-tax-deadline-delayed-to-may-17-2021

Review the current 2020 Tax Brackets and Tax Rate table breakdown. The 20212022 FAFSA Verification-IRS Tax Return Transcript Matrix is applicable only for US. In Revenue Procedure 2021-25 the IRS released the 2022 inflation-adjusted figures for contributions to HSAs which are as follows. In Revenue Procedure 2021-25 the IRS confirmed HSA contribution limits effective for calendar year 2022 along with minimum deductible and maximum out-of-pocket expenses for the HDHPs with which.

Source: https://www.indinero.com/blog/2021-business-taxes-deadlines

According to the payment option you need to enter your bank details such as bank account number routing number etc. If the employer deferred paying the employer share of social security tax in 2020 pay 50 of the employer share of social security tax by January 3 2022 and the remainder by January 3 2023. File IRS Tax Form 2290 Online from our website. Use the new RATEucator below to get your personal tax bracket results for Tax Years 2020 and 2021.

Source: https://www.efile.com/irs-income-tax-return-forms-and-schedules-for-year-2022/

IRS Form 1040 Line 14 minus Line 2 of Schedule 2 43a and 91a 50 and 113 Schedule 3 Line 3 57 and 120 Schedule 1 Line 15 plus 19 59 and 122. The due date for furnishing return of tax deduction has been extended from May 31 2021 to June 30 2021 vide Circular no. The irs tax refund schedule dates according to the irs are 21 days for e filed tax returns and 6 to 8 weeks for paper returns. You will instantly receive your 2290 Schedule 1 at an affordable price.

Source: https://www.checkcity.com/blog/taxes-101/wheres-my-refund-the-irs-refund-schedule/

The IRS generally releases the inflation adjustments towards the end of the year at around mid-December. Use the 2022 Tax Calculator. Federal income tax brackets were last changed one year ago for tax year 2021 and the tax rates were previously changed in 2018. 2021 Estimated Tax Due Date.

Source: https://bartabusinessgroup.com/irs-2021-tax-due-dates/

Visit this page on your Smartphone or tablet so you can view the Online Tax Calendar on your mobile device. You can see all events or filter them by monthly depositor semiweekly depositor excise or general event types. The internal revenue service will release the new tax brackets in the upcoming months. 31 March 2022 2021 income tax return due for clients of tax agents with a valid extension of time 9 Quarterly FBT return and payment due 10 Annual FBT return and payment due 11 Income year FBT return and payment 7 April 2021 2020 income year return and payment due for clients of tax agents with a valid extension of time 7 February 2022.

Source: https://www.moneycrashers.com/quarterly-tax-deadlines-irs-tax-calendar/

When you file your 2021 tax return in 2022 if your tax situation isnt what the IRS has in its system and you werent entitled to as much as you received youll have to give the overpayment back. 2021-2022 FAFSA Verification-Internal Revenue Service IRS Tax Return Transcript Matrix Attached to this Electronic Announcement is the 2021-2022 FAFSA Verification-IRS Tax Return Transcript Matrix that institutions can use for 2021-2022 verification of IRS tax return information included on the Free Application for. Any payments or deposits you make before January 3 2022 are first applied against the first 50 of the deferred employer share of social security tax and then applied against the remainder of your. The irs tax calendar for businesses and self employed is available online at irs gov taxcalendar.

Post a Comment for "2022 Irs Tax Calendar"